Americans, Green card holders living and working abroads, Members of the military, American Overseas Contractors working in the military bases, American Seniors and Retirees living abroad

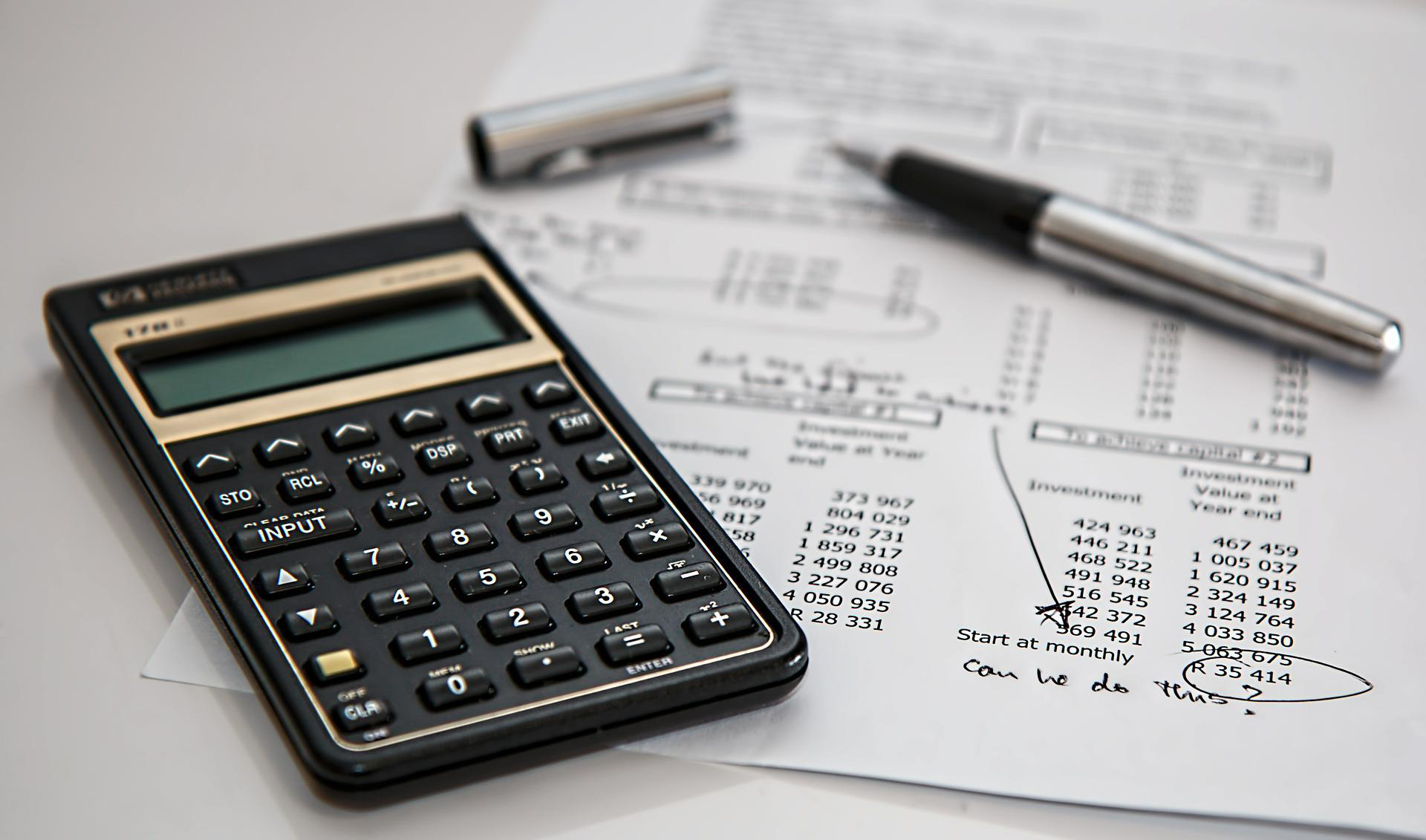

U.S. persons (U.S. citizens; U.S. residents, U.S. entities, U.S. trusts or estates) are required to file an FBAR (FinCen Form 114) when the aggregate value of all foreign financial accounts exceed $10,000 at any time during the calendar year reported..

Americans and Resident aliens who received gifts from nonresident aliens more than $100,000 during the calender year will be required to file a Form 3520. Anyone who owns more than 10% of a foreign corporation will be required to file a Form 5471.

FREE E-file of returns.

We are authorized IRS e-file providers.

We are qualified to prepare, transmit and process e-filed returns.

Our expert tax prepares have years of experience helping expats to comply with IRS tax filing requirements to avoid stressful tax audits and penalties.

FBAR filings have risen dramatically in recent years as FATCA phases in and other international compliance efforts have raised awareness among taxpayers with offshore assets. Taxpayers with an interest in, or signature or other authority over, foreign financial accounts whose aggregate value exceeded $10,000 at any time during 2022 must file a form FinCEN 114 with the Department of Treasury by April 18, 2023 (or Oct. 16, 2023 if filed a Form 4868). FATCA refers to the Foreign Account Tax Compliance Act. The FATCA Form 8938 requirement does not replace or otherwise affect a taspayer's obligation to file an FBAR Form 114.

U.S. citizens and resident aliens (Green card holders), including those with dual citizenship who have lived or worked abroad during all or part of 2022, may have a U.S. tax liability and filing requirement in 2023. A filing reqirement generally applies even if a taxpayer qualifies for tax benefits, such as the foreign earned income exclusion (TY 2022: $112,000) or the foreign tax credit, that substantially reduce or eliminate their U.S. tax liability. These tax benefits are not automatic and are only available if an eligible taxpayer files a U.S. income tax return.

Quality is never an accident; it is always the result of intelligent effort. We do everything to make our clients happy with the best qualify. Better the last smile than the first laughter.